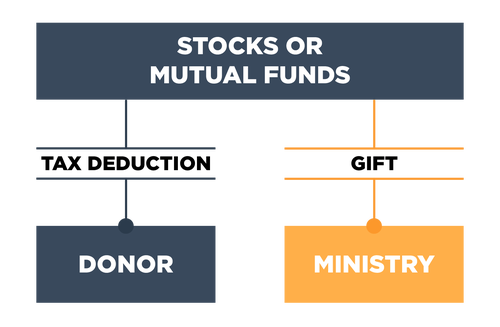

Gifts of appreciated securities are a smart and simple way to maximize the effectiveness of your charitable giving. If stocks or mutual funds* you’ve held for more than a year have increased in value, you may want to consider using these assets – rather than cash – to fund your giving. By transferring ownership of your long-term stock to Calvary San Diego you make a gift to support the ministry, avoid the capital gains tax you would pay if the stock were sold, and you may claim a charitable income tax deduction for the current fair market value of the asset.

*Does not apply to tax-exempt retirement plans (e.g., IRAs, 401(k)s, etc.)